Lending Club update time! As I did in previous months, I’ll show you my investing returns in two ways. First, what Lending Club calculates for me:

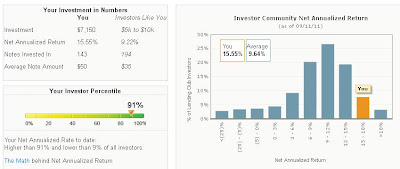

Pretty consistent with last month’s number of 15.42%. My NAR has crept up a little bit because I’ve been investing in more notes with higher interest rates recently. Interesting to note that I’ve had another loan fully repaid. How do I stack up against other Lending Club lenders?

Also pretty similar with last month. Here's an interesting article on this investor percentile comparison from Peter at Social Lending Network. In the article, Peter makes the case that this tool should compare your portfolio against others with similar loan ages. I agree 100%.

As it currently stands, any new portfolio is going to have this investor percentile number inflated. This is because it takes 120 days for a loan to go into default, so new portfolios have no chance of a default hitting their sheets.

As an investor, I like having the investor percentile tool. But I don’t want to compare my returns to someone else’s who just set up their account and has none of the older loans that I have. I want an apples to apples comparison. If I can compare my portfolio to portfolios with similar loan ages, then that investor percentile number is infinitely more useful in providing an accurate read of the quality of my investing strategy.

With that said, I’m going to keep including the investor percentile tool in future updates. I just hope that Lending Club revises it so that it compares my portfolio to others with similar average loan ages.

Now let’s calculate my returns using the Lending Club monthly statements.

As of 8/31/2011, I have $8219.82 in my Lending Club account. Using the XIRR function in Excel, I get a calculated NAR of

Just like last month, there is a discrepancy between my NAR and the NAR calculated by Lending Club. And just like last month, I believe most of the discrepancy arises from my most recent deposit of $1,500 on 8/16/2011. There’s nothing wrong with this deposit, but because I didn’t immediately invest the cash into loans, it will weigh heavily on my NAR. If you look at my NAR using the account total for today, you find

This 14.04% is much closer to the 15.55% generated by the Lending Club website.

As I mentioned last month, I set up a recurring transfer of $1,500/month into my Lending Club account. Even though I invested $1,500/month in July and August, I have since disabled this recurring transfer. This is because I have had around $1,400 or so of available cash that’s just been sitting in the account. Once I have invested this amount and my available cash is close to $0, I will start the recurring transfer back up again.

A quick note on the recurring transfer: I talked to a Lending Club representative and was told that there was still a 1.5% cash bonus for recurring transfers (as I mentioned last month). I explained that I could not find a link to get this set up on the site. The representative told me that she would activate it for my account. Of course, because I have since disabled recurring transfers, I will no longer receive this bonus.

So, if you want to have this bonus activated but can’t find it on the Lending Club site, I encourage you to contact Lending Club. I will provide an update on the cash bonus once I have re-enabled my recurring transfers.

A final note: I am bumping up my loan investments from $50/loan to $75/loan. Keeping my monthly transfer the same at $1,500, this means I will only have to find 20 suitable loans per month instead of 30. Loans that pass my filters are getting a little bit more uncommon (no surprise as my filters get stricter), so this will enable me to deploy the capital that I want on a monthly basis.

The information available at Michael Grabowski is for your general information only and is not intended to address your particular requirements. This information is not any form of advice by Michael Grabowski and is not intended to be relied upon by users in making any investment decisions. Michael Grabowski is not liable for any loss or damage which may arise directly or indirectly from use of or reliance on such information.

No comments:

Post a Comment