I was initially worried about posting my Lending Club investment strategy out in the wild. Why would I give the ingredients to my secret sauce for free? But my secret sauce isn’t so secret, it’s really a combination of a lot of different strategies that I’ve read, mostly the strategy from Matt at Steadfast Finances.

Interesting enough, Matt no longer invests in Lending Club because of a rule change that allows you as an investor to only ask a few pre-approved questions to borrowers. This isn’t a deal breaker for me considering that both these questions and loan descriptions are not verified by Lending Club. I use my filters to examine if a borrower is credit worthy and then use the question and loan descriptions to filter only if there is something egregious there.

For instance, recently there was a loan that otherwise passed my filters but was entitled “Get out of debt free card”. That doesn’t exactly inspire confidence that the borrower is going to take this obligation seriously, so I didn’t fund it.

A few quick notes before we get into my filters. These loans are a fixed income instrument. So if everything goes perfectly (borrowers pay in full and on time), you will at the most get back the interest rate at which you lent your money out. Defaults cut into this return on investment.

For simplicity sake, let’s say I lend out $100 each in 100 different interest only loans all at 10% interest. So I have lent out $10,000 and over the course of a year I at the most can receive $1,000 in interest, for a 10% return on investment. Now let’s say 2 of my loans never make any payments and default. I lose my $200 outlay on these two loans (I have a 2% default rate) and will never get the $20 in interest I expected from these two loans over the course of the year. So my return is now $1,000 - $200 - $20 = $780, giving me only a 7.8% return on investment.

So defaults are pretty important. But my investment goal IS NOT to minimize defaults, it IS to maximize returns. I’ve seen a few people invest only in A1 loans on Lending Club because they have the lowest default rates but they also have the lowest interest rates, currently around 5.5%. Maybe it’s just me (and it probably is, because these loans are not having trouble getting funded) but I wouldn’t give a personal loan for 3 to 5 years to Mother Theresa at 5.5% interest. Just a few years ago savings accounts with no risk of default were yielding that much! Why would I lock up my money for such a long time at such a low interest rate in a personal loan?

Let’s finally get to my filters. We’ll start at the end. After I have applied all of my primary filters (which I’ll get into in next week’s post), I then filter by

1. Interest rate: This only makes sense, right? If a bunch of loans pass all my tests, then I want to invest in the loans which will net me the greatest return, the ones with the highest interest rates. Naturally, these loans will have a higher risk of default but I believe that my filters will minimize this risk, resulting in a higher return on investment. So the bulk of my loans are around the C grade of 14% interest.

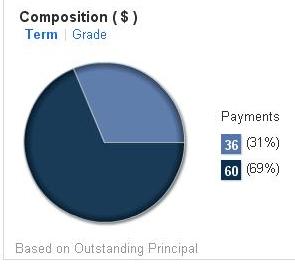

2. Term of loans: Some people prefer to invest in 5 year loans because they have higher interest rates and borrowers make lower payments for the same loan amount. I dislike 5 year loans because they lock up my money for an additional 2 years in a most likely rising interest rate climate. It is also an additional 2 years where the borrower can face divorce, job loss, etc. For these reasons, I choose 3 year loans over 5 year loans with all other things equal. However, 3 year loans are few and far between, so this is my portfolio composition.

2. Term of loans: Some people prefer to invest in 5 year loans because they have higher interest rates and borrowers make lower payments for the same loan amount. I dislike 5 year loans because they lock up my money for an additional 2 years in a most likely rising interest rate climate. It is also an additional 2 years where the borrower can face divorce, job loss, etc. For these reasons, I choose 3 year loans over 5 year loans with all other things equal. However, 3 year loans are few and far between, so this is my portfolio composition.3. Loan amount (monthly outlay): Say two borrowers are exactly the same in every respect, except that one wants a loan for $10,000 to consolidate his consumer debt and one wants $20,000 for the same purpose. The first borrower will have a lower monthly outlay and I believe he will have a smaller chance of defaulting, so with all things equal, I will choose to fund the first over the second.

Next week we’ll dig into my primary filters.

The information available at Michael Grabowski is for your general information only and is not intended to address your particular requirements. This information is not any form of advice by Michael Grabowski and is not intended to be relied upon by users in making any investment decisions. Michael Grabowski is not liable for any loss or damage which may arise directly or indirectly from use of or reliance on such information.

No comments:

Post a Comment